2022 Has Our Interest

Robert Napolitano

Director of Investment Strategy

It wasn’t quite the “shot heard ‘round the world,” but Russia’s invasion of Ukraine on February 24th is one of the most significant military actions the world has seen in the post-war era. Geopolitical turmoil in Eastern Europe has quickly taken the limelight from the inflation and interest rate headlines that spurred volatility and dominated the media earlier this year. To no one’s surprise, this has led to a rise in market volatility as the tenuous situation overseas has escalated from aggressive political rhetoric to a full-blown military conflict. Last night it came to a head as Russian armed forces attacked several critical military targets across Ukraine, while Russian President Putin vowed to replace Ukraine’s government with one that was more closely aligned with the interests of Moscow.

We understand the numbers have been front and center. As with any sudden or unexpected news, markets react quickly and emotionally at first, this time being no exception. The S&P 500 is almost 13% off its high reached on January 2nd, pushing the bellwether US index safely into correction territory (defined as a 10% decline from a high). Other domestic and international indices have also trended lower as investors and markets try to digest a myriad of economic and geopolitical data points in a short amount of time.

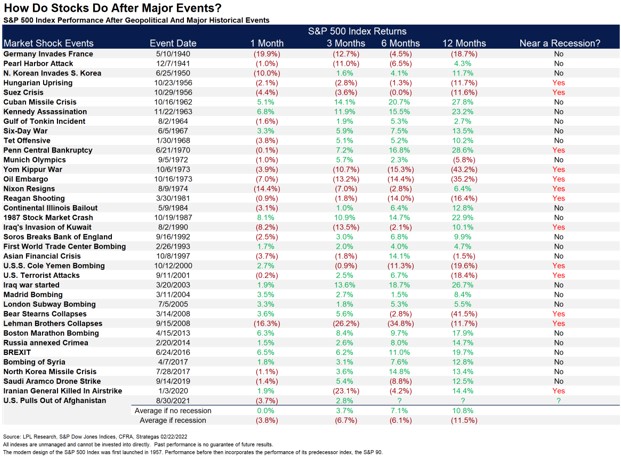

We do not want to downplay the severity of an international conflict (especially one that will undoubtedly result in the loss of hundreds or thousands of lives), nor do we understand exactly how this will play out. What we do know is that risk is the only constant in investing in financial markets, and this time is no different. It may manifest itself in the form of inflation, a pandemic, political divisiveness, a financial crisis or even a war, but underlying risk is what makes investing rewarding for those with the patience and discipline to keep clam and carry on. With respect to geopolitical conflicts, in particular, it is important to keep history in mind as we navigate the current environment. Short of full blow world wars, these types of conflicts have rarely, if ever, been the driving force behind a recession – especially if the United States is NOT involved militarily. Additionally, many times when a recession has occurred, it has been in conjunction with other major economic events, meaning the timing of which may have been more coincidental than catalytic.

Looking at the chart above, if the economy can avoid a recession, most of the events tend not to have major long-term negatives for stocks. In fact, under most cases when a recession does not occur, stocks are up more than 10% a year later, versus down 10% if there is a recession. Positive COVID trends notwithstanding, a strong consumer and corporate backdrop can help to provide fundamental support as markets normalize, potentially creating short-term opportunities after the knee-jerk reaction drawdowns.

Our message remains consistent in the face of the many challenges that investors are faced with. We recommend turning the focus on broader planning issues in the midst of market volatility, which is admittedly not always easy. This time of year, the focus should be on tax planning and making proactive adjustments to minimize your tax bill for the upcoming tax year. It is also a good time to review your last year’s results, cash flows and evaluate your progress toward your long-term plan goals.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.

The content is developed from sources believed to be providing accurate information.

Tracking: 1-05248966